Banking and financial institutions - banks, investment, analytical companies or financial companies - operating all over the world and contribute to the Fonds de Garantie des Dépôts et de Résolution (FGDR) and are licensed by the Prudential Supervision and Resolution Authority (ACPR).

Their membership in the FGDR is a prerequisite for conducting their business. In the event that one of them fails, the FGDR protects and compensates its customers through three mechanisms: the deposit guarantee scheme, the investor compensation scheme and the performance bonds guarantee scheme.

Each FGDR member institution is identified by an INSTITUTION CODE.

-

For a bank: see the first five digits of the heading "Establishment", "Bank " or "Bank Code" mentioned on your bank details.

-

For a financing company or investment firm, see your account statements or ask your advisor for the INSTITUTION CODE.

To check whether your institution is a member of the FGDR and to identify the guarantee mechanism(s) under which you are covered, use the search engine below.

On 05/06/2024

1173 results have been found

SG option Europe

Banque de Polynésie

Banque BIA

Caisse régionale de crédit agricole mutuel des Côtes-d'Armor

Banque de Tahiti "B.D.T."

Allianz banque

What coverage is provided under the deposit guarantee scheme for banks operating in France and abroad?

Banks and subsidiaries of foreign banks in France

For their entire network in France and Monaco, the FGDR covers:

Banks licensed in mainland France, including subsidiaries of foreign banks whose head office is located in mainland France or in the overseas territories (Guadeloupe, French Guyana, Martinique, Mayotte, Réunion, Saint Pierre and Miquelon, Saint-Barthélemy, Saint-Martin, French Polynesia, New Caledonia, Wallis and Futuna).

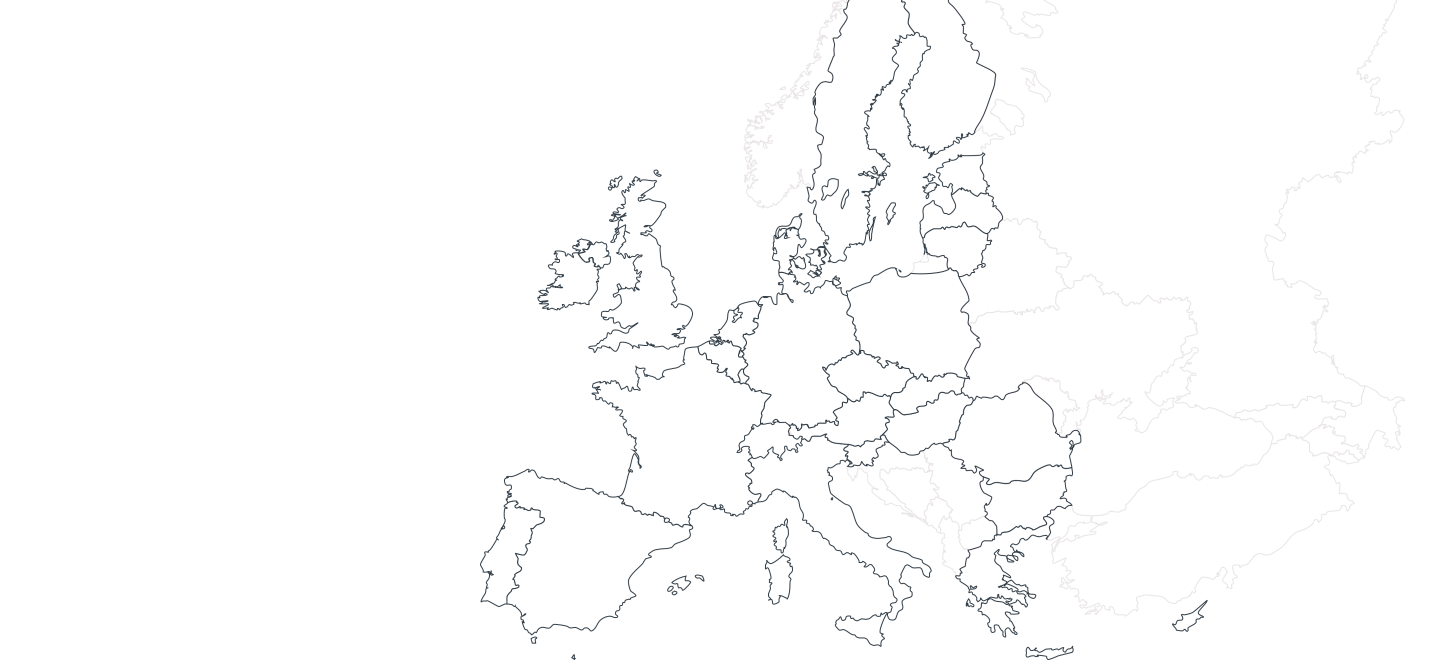

European Economic Area

Branches/sales offices of member institutions in France located in countries of the European Union and the EEA

The FGDR covers the branches (or sales offices) based in the member countries of the European Union and the European Economic Area of all banks licensed in mainland France and overseas.

Banks whose head office is located in Monaco

The FGDR covers banks/credit institutions whose head office is located in the Principality of Monaco, as well as their branches in France, the Principality of Monaco and the other countries of the European Union and the European Economic Area.

Institutions covered by the FGDR and Brexit

Customers of a UK-based branch of a bank licensed in France are covered by the British guarantee scheme (FSCS) based on conditions similar to those of the FGDR.

France-based branches of a UK bank and Brexit

Customers of a France-based branch of a UK bank are currently covered by the French deposit guarantee scheme (FGDR) in the same way as all customers of banks licensed in France, under conditions similar to those of the FSCS.

Frequently asked questions

Are online banks covered by the FGDR?

As a general rule, the deposit guarantee applies to all banking institutions that are members of the FGDR, including those operating as on-line banks. Banks increasingly offer online or remote banking services. However, you should ask your bank to find out whether the online services offered to you are provided under a trademark created within a banking institution working under another name, and which banking institution this is. Indeed, the benefit of the deposit guarantee scheme up to €100,000 per customer and per institution only applies once within the same banking institution operating under several trademarks.

To verify your coverage under the deposit guarantee scheme, check the Bank Code shown on your bank account details. All accounts with the same “Bank Code” are added together under the €100,000 ceiling since they are held by the same banking institution.

→ Refer to the “Check if your bank is protected” section using the “Bank code” shown on your bank account details.

Is the branch of a French bank located in another country of the EEA covered by the FGDR?

If a French bank operates in another EEA country through a branch, that European branch is covered by the FGDR, since the FGDR is the guarantee scheme of the parent company.

Within the European Union, guarantee schemes cooperate to compensate customers under the best operational conditions.

Are payment institutions and electronic money institutions covered by the FGDR?

These institutions – called PI/EMI – are not covered by the deposit guarantee scheme since they are not banks and are therefore not members of the FGDR.

However, customer funds are protected either by special insurance taken out by the institution or through a ring-fenced account opened at a bank in which these funds are kept separate. If the payment institution fails, customer funds are protected by these mechanisms (see Article L. 522-17 of the French Monetary and Financial Code). The FGDR is not involved.

The FGDR would become involved only if the bank at which the payment institution opened a ring-fenced account were to fail. In this case, the FGDR’s deposit guarantee would apply to the entire ring-fenced account, up to a maximum of €100,000 for each of the PI/EMI's customers.

Find all the information about the coverage of neobanks and fintech here